Last week, the behemoth Berlin (and beyond) luxury department store KaDeWe filed for bankruptcy, despite an impressive 24% record-breaking sales increase post-pandemic. The Landmark of Wealth tenant has been the only resident in the 90,000 square meter West Berlin building, and yet, they were not spared a 37% increase in rent this year. (Join the club!)

For the fashion, business, or economy mavens, this comes as no surprise: simply look to other department store trajectories in the last five years. In Berlin, Karstadt shuttered all but one of its beloved mid-tier department stores at the start of this year. New York saw the closure of its iconic Barney’s and Century 21 stores (and let’s not even get into the mass layoffs at Macy’s), both filing for bankruptcy after a long struggle to stay afloat during the online shopping frenzy that came along well before Corona did.

We are left considering: if this can so blatantly happen to KaDeWe, of course it is happening rampantly to other smaller businesses. But are the smaller businesses also getting bail outs from the city?

Through this debacle, it was publicly revealed that KaDeWe was granted a 90 million EUR loan from the Berlin senate (read: your tax money) in 2020, despite not disclosing its financial records. This loan went toward a thorough revamp of the top floor’s ‘Food Hall’ which opened in 2022’s holiday season, as well as redesigns and renovations throughout the rest of the six floors. I’m very sorry to tell you, but we the Berlin public tax payers have allotted the KaDeWe group nearly one billion euro since Corona. Let that sink in. We are footing bills for luxury shoppers, while our friends can’t find a single room flat in Wedding for less than a grand.

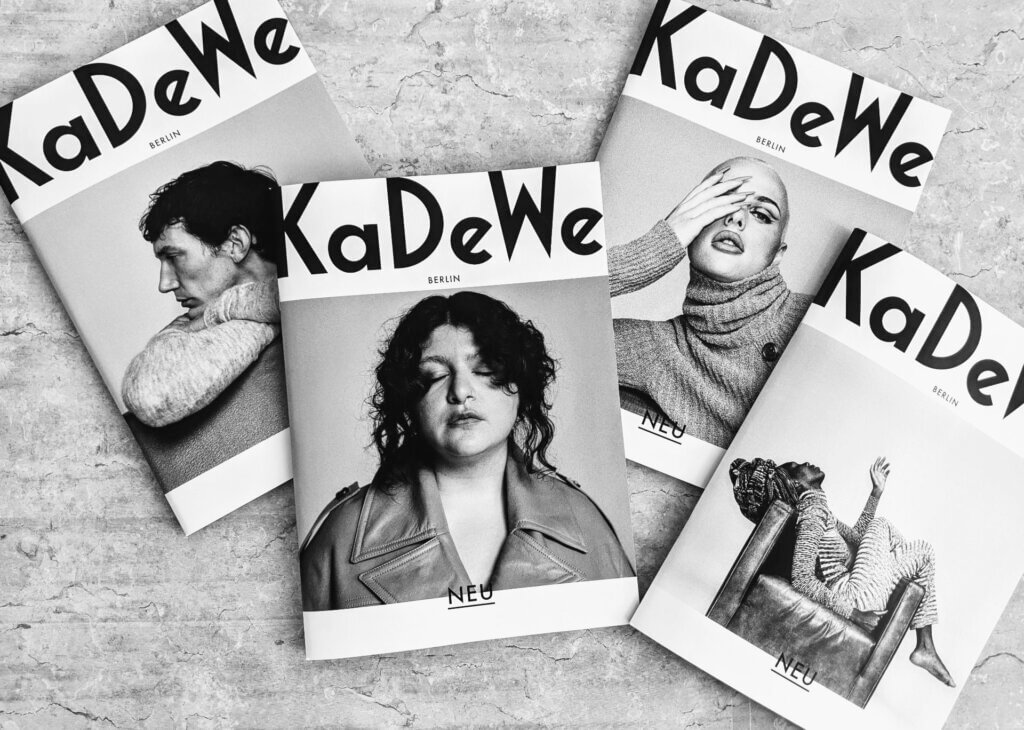

This concept is disturbing, and yet I can’t help but feel a tug of nostalgia for what these luxury department stores can indeed offer the public. Apart from employing over 900 city residents, the idea of KaDeWe disappearing is sad in its own regard. Much of the visual merchandising has been a source of inspiration and magic, especially during the holidays- regardless of age, gender, or tax bracket. They had a beautiful in-house magazine, featuring exclusive interviews with designers and buyers. And while the department store may best be known for its ground floor ‘Luxury Boulevard,’ KaDeWe also proudly featured a revolving rolodex of smaller brands and local artisans, dispersed throughout its floors.

We are living in a time of instant gratification via online shopping, with shiny allures of free shipping and long line avoidance, but this does not make the need for a physical shop obsolete. If anything, this opens up the need to make the experience of in-person shopping all the more special. As an avid shopper of KaDeWe myself, with a number of friends having worked at the department store in various sectors and roles, we all came to agree that the appeal of shopping off-line has greatly diminished as of late. The overall facade of joy is crumbling. Budget allocations have gone to paying for renovations rather than non-branded store windows.

As a KaDeWe industry cardholder, I would receive small presents during the holidays and on my birthday. Other perks included invites to discounted late shopping hours, complimentary glasses of house Prosecco on weekdays, invites to pop up launches and reveals. None of that has happened the last two years, and I’m not the only one. It’s hard to be encouraging of a company that cuts the customer’s happiness as their first loss.

By 2025, KaDeWe is expected to open a new department store in Düsseldorf, as well as a new large scale luxury shop in Vienna. If KaDeWe hopes to solidify a new in-person customer base, visual merchandising and appreciative gestures need to be paramount. It’s so much easier to shop from bed with promised free shipping and returns (in better lighting, to boot.) Why else do we make the trek? The primary allegiance to customer has greatly diminished in the time since KaDeWe’s 2020 bail out, and it seems a much easier (and cheaper) fix than adding more marble walls and doughnut shops to a top floor.

The other issue here is the exorbitant increase of rent, which Berliners have been complaining about for years. Last year, it finally came to a head that no one could ignore, when it was revealed by Deutsche Wohnen & Co. Enteignen that within six years, Berlin rent has jumped an average of 44%. The Economics Review at NYU conducted a study on the housing crisis, and its continuously failed reforms. Displacement is not a good business model.

The conundrum I am faced with, on if I should pledge allegiance to such luxury stores prevailing when there are so many other problems in my chosen city is this: KaDeWe is a Mecca of capitalism, of flaunted wealth and hyper-consumerism. But they are honest with this intention, and sometimes good can come out of it, even if we the citizens are not partaking in it.

The issue is Berlin choosing to bail out such a giant in the industry, time and time again, meanwhile leaving its residents to foot the bill, without doing so much for them. I have friends who were recently asked to pay back their Corona relief fund. I have neighbours being kicked out of their flats to make way for millionaires wishing to expand their flat to a three story home rather than two. Each year, we pay more money for BVG fares, only to have diminished services. Massive construction sites (and their sounds) pop up once a week to remain for years, only to cater to new buildings we the people will never have access to. Small cafes are taken over by big cafes, proudly proclaiming ‘No Cash’ signs. Small boutiques beg for credit and take out personal loans to keep up with the ever-increasing rent by ever-greedy landlords who don’t even live in Germany.

We can’t compete with KaDeWe. We don’t need to! But we can and we should question if this is what we want 44% of our personal income going toward, while we ourselves struggle, fight, move, apply, and steadily deal with the paramount climbing issues the capital city is glazing over, in favour of bailing out a corporation with over 50% of its stakes based in Thailand. They can’t distract us with shiny windows and glasses of top floor champagne for much longer, before the golden patina starts to crack.